Intelligent Accounting

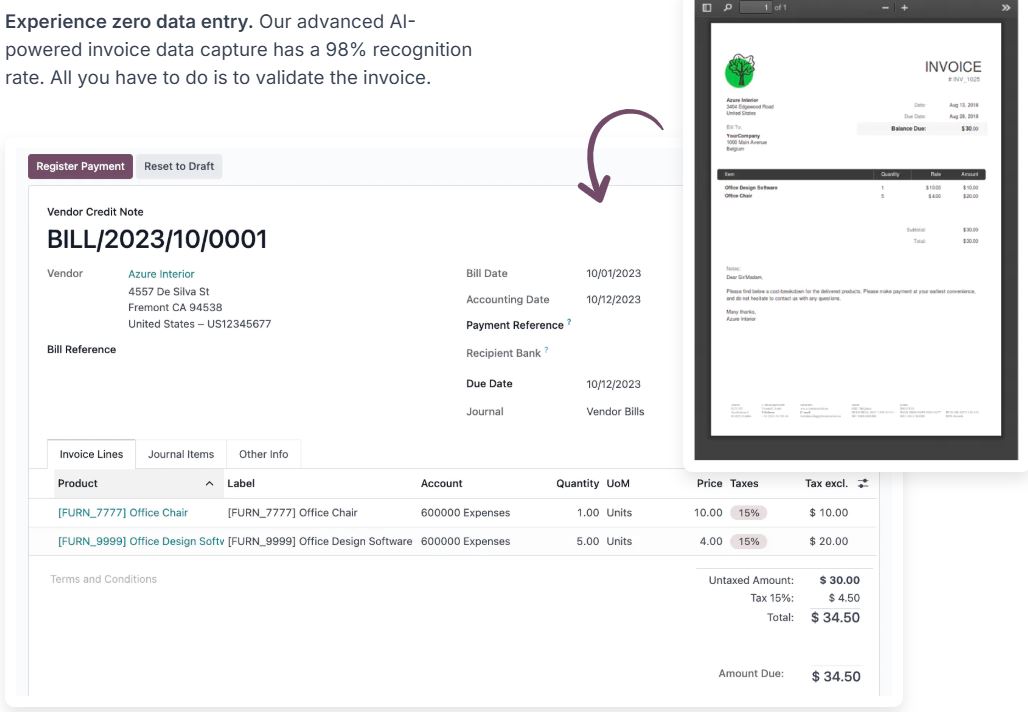

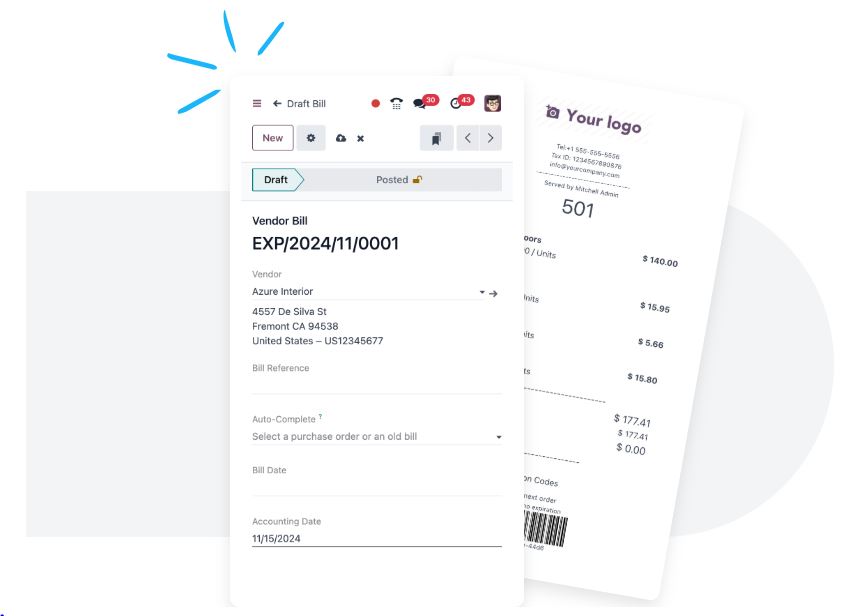

Synergy is intelligent accounting software. You will experience bookkeeping differently. No more entering data multiple times. Leverage AI-assisted invoice capture, bank reconciliation, and tax recording. All connected to every other part of your business.

Including on mobile...

Take pictures of your expenses, and let the Artificial Intelligence do the rest!

Smart bank reconciliation

28,000 banks supported

Bank synchronization

Never import bank statements manually again. Synergy integrates with 28,000 banks from all around the world!

Smart AI matching

95% of the transactions are matched automatically with the financial records.

All the features you need, done right

Worldwide Compatibility

Synergy is pre-configured to address your country's requirements: charts of accounts, taxes, country-specific reports, electronic invoicing, audit files, and fiscal positions to automatically apply the right tax rates and accounts.

Automated follow-ups

Synergy helps you identify late payments and allows you to schedule and send the appropriate reminders based on the number of days overdue. You can send your follow-ups via different means, such as email, post, or SMS.

Real-time reporting

Real-time financial performance reports empower you to make informed decisions for your business. Additionally, you can easily annotate, export, and access detailed information for each report.

Deferrals

Defer your revenues and expenses, either manually or on each invoice/bill validation. You can also audit the entries from dedicated reports.

Electronic invoicing (EDI)

Various EDI file formats are available depending on your company's country. Send and receive electronic invoices in multiple formats and standards, such as Peppol. List of supported formats

Dynamic taxes and accounts

No matter where your customers and suppliers are established, if they have a Tax ID or not, if the goods are sold cross-border, Synergy computes the right taxes and income or expense accounts.